Kisan Credit Card (KCC) is an evolution in agriculture loans. To ease the financial stress of the farmers during cultivation, harvest and daily needs Kisan Credit Card (KCC) came into existence. Further, RBI directed all banks to route crop loans through KCC to avoid diversion and misuse of funds.

The initiation phase was in 1998, intending to provide short term credit to cultivators. Further, the rate of interest was feasible while providing loans to both farm owners and leasers. Since then, the process of applying has been abridged to attract a large crowd. Additionally, there is ease while repayment of the loans too, decreasing the burner of the cultivator.

Objectives of the scheme

- To reach out to over 1 crore farmers and support their livelihood.

- Replace the high risk orientated informal borrowing with formal credit.

- Provide low-interest loans with huge benefits.

- Farmers attain easy access to credit to procure seeds, fertilizers, pesticides, manure, etc.

Availability of the KCC benefits

The KCC is an Indian government initiative, however, most banks including private banks, NBFCs and public sector banks in India provide KCC including:

- National Payments Corporation of India (NPCI)

- National Bank for Agriculture and Rural Development (NABARD)

- Cooperative banks

- State Bank of India (SBI)

- Industrial Development Bank of India (IDBI)

For instance, SBI provides a 5-year tenure card with PAIS, assets and crop insurance. On the other hand, the Bank of India provides the same, however, it does not cover the insurance. Likewise, axis bank provides tenure for 5 years with insurance up to Rs 50,000. That apart, several banks host the same across the country.

Importance of KCC?

As of now, the adaption of KCC is noted in Regional Rural Banks, Cooperative Banks and Public sector commercial banks. Considering, the prime objective of the scheme is to provide beneficial loans. Thereby, it facilitates credit for agriculture and associated activities such as harvest marketing loans and loans to aid post-harvest expenses. Further, assistance with subsidiary fiscal aid for crop cultivation along with crop insurance is part of the scheme. Moreover, the budget supports the cause and over 15 lakh crore is available for the year 2020-21.

Characteristics of the KCC scheme

The salient features of the scheme are:

- The eligible cultivator will receive a smart card (works as a debit card) along with the Kisan Credit Card.

- There is no limit for withdrawal in case of revolving credit and proper repayments. However, it is advisable to repay the withdrawals in 12 months in installments.

- The rate of interest is set by the respective banks. Nonetheless, the rate must range between 9- 14%.

- The annual reviewing of the credit card determines its validity. Consequently, the bank is in charge of this annual review function.

- It is possible to expand the credit limit by notifying bank on the cropping pattern changes, rise in operating charges, etc. Nonetheless, this is applicable only if the cultivator maintains a good record on the usage of credit card.

- The pattern of loans can be modified in case of natural disasters damaging the crops.

Profits to be availed via KCC scheme

As cited earlier, the scheme provides easy access to financial benefits for the harvesters. Besides those, a few significant advantages from the KCC scheme are:

- The repayment options are not rigid.

- Aggravation- free distribution of loans.

- Loans for all agricultural and ally sects through single credit or long- term loan facility.

- Aids in procuring seeds, fertilizers, etc., with discounts.

- 3 year credit availability, also, repayment can be after the harvest.

- Credit is attainable with minimum documentation and flexible procedure to acquire it.

- Funds are attainable at banks all across the nation.

Eligibility Credit

It is well aware any cultivator is eligible to enjoy the benefits of the KCC scheme. Hereon the categories of the same are listed:

- A group of owners-cultivators as cooperative borrowers

- A lessee, a tenant, or share cultivator

- A self- aid group or joint accountability group of lessees, tenants, or cultivators.

Besides the traditional farmers, fisheries and animal husbandries act as beneficiaries of the scheme.

- Internal Fisheries and Aquaculture

- Marine fisheries

- Poultry

- Dairy

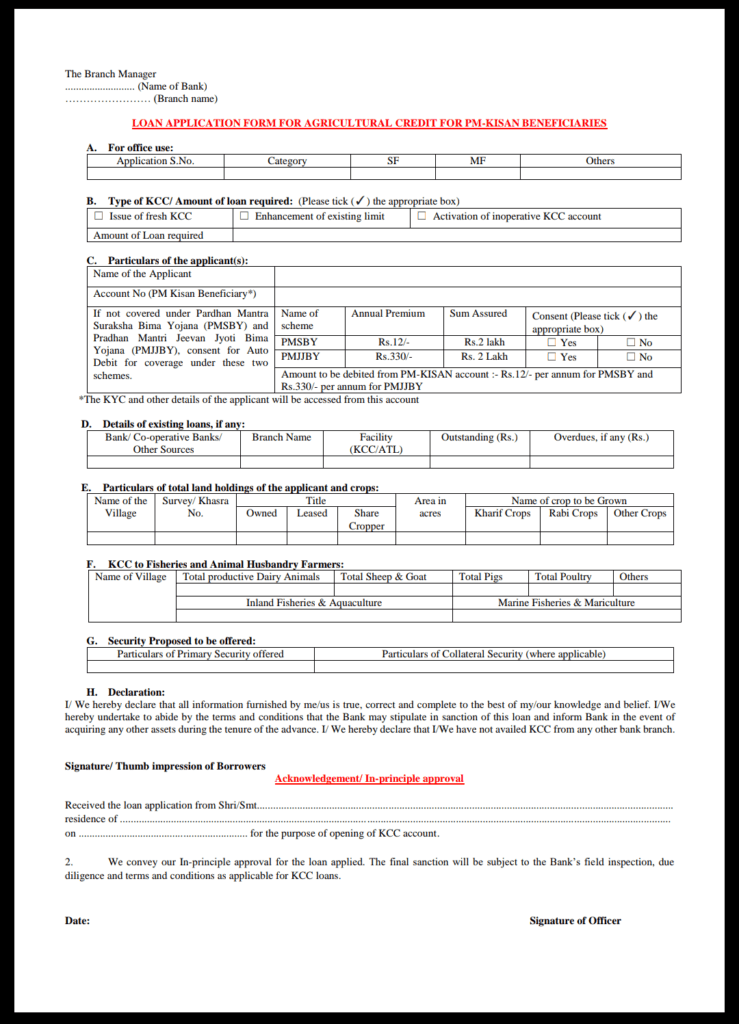

Necessary documents for KCC application

The notification from Reserve bank of India (RBI) suggests the applicants provide documents as per their respective bank’s guidelines. Thereby, a set of general documents necessary is as follows:

- Application form

- Identity proof copy (Aadhar card, PAN card, Voter ID, Driver’s license, etc.)

- Address proof

- Land Documents

- Passport size photo

- Supporting documents such as Security PDC on request from the bank

Procedure for applying for KCC scheme

- Initially, go to the official website of the bank

- Select the Kisan Credit Card option from the list of credit cards

- Subsequently, click on apply option

- Following that, an online application page will appear

- Further, fill the form duly

- Submit the form

- Finally, is the generation of reference number (save it for future references)

Next, over the course of 3 to 4 days, the applicant will receive a call from the bank to provide an update on the application status. Further, submit the necessary documents on the notified date of the appointment. Consequently, after thorough scrutiny and verification, the applicant will receive the card to the address (in the application form).