Credit availability is always a challenge for MSMEs. It is due to their small asset size and lack of credit history that banks and other sources of traditional financing systems discern them as high-risk debtors. Coming over this limitation, crowdfunding as a modern financing system is a real working capital option for MSMEs in India. Kickstarter, Wishberry and Ketto are a few crowdfunding organisations in India.

What is Crowdfunding?

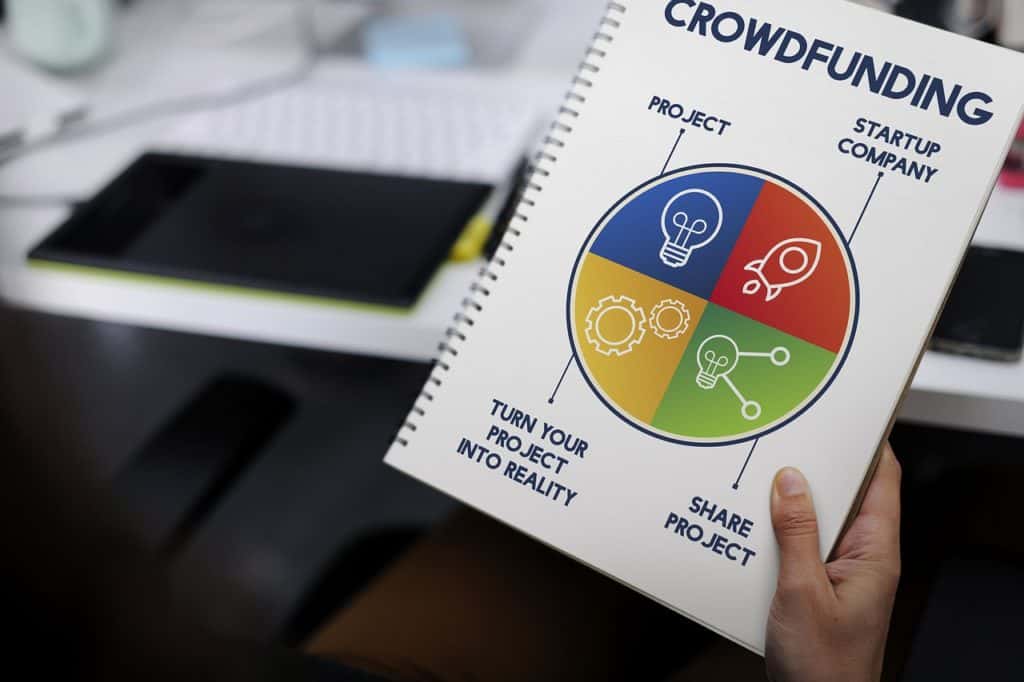

Crowdfunding is to generate small amounts of capital from a large number of investors. It is characterized by its easy accessibility using technology. This technology-based platform act as an intermediary between the entrepreneur and the investor providing them the information about the opportunities to invest. These platforms not only provide finance for the working but also serve as strategic support to company’s.

There are Four types of Crowdfunding:

1. Reward Based crowdfunding

This model works on the setting of reward for making a particular amount of investment. Set by the fundraiser, this reward can be in the form of interest rate on the amount invested or it can be a specific amount of money as decided. This works as an encouragement to the investors.

2. Equity Based Crowdfunding

In this model, the company seeking funds issues shares to the investors and offer them to become a stakeholder in the company, using an online platform for crowdfunding. Initially, the company raises funds through private equity, angel investors and loan arrangements with financial institutions. Once the business becomes commercially viable, it can open its equity to the public.

This method is highly risky and thus calls for regulations. There are no regulatory framework yet for the legal status and authorization of the platforms generating equity-based crowdfunds.

3. Donation Based Crowdfunding

This method involves asking the investors for donations for a charity based project. It is an easy method to raise funds. The project is cause-driven benefiting the society and may or may not associate rewards with the amount of donation made. This method is used for raising money to aid certain researches, for disaster relief or organisations working on a social mission.

4. Debt Based Crowdfunding

Debt based crowdfunding is similar to a bank loan. Here the company’s raise funds from individuals and instead of paying them a part of profits they pay them interest on money borrowed.

Choose according to your needs

A business should not go for the popular crowdfunding website. Analyze your needs and see if the crowdfunding matches your requirements. There are certain limitations associated with several crowdfunded. If you do not reach the goal of raising the mentioned amount of money, the whole process goes in vain. Therefore, choose the platform wisely.

Unrealistic goals

It is advised to analyze the budget and then propose to raise money. Include the platform’s share and any uncertain cost in the budget to meet the goal. It is inappropriate to ask for an unnecessary amount of money because if you are unable to meet the set standard, all the money becomes futile. Further we recommended company’s to raise funds in stages avoiding a call for a huge amount. This makes the goal achievable and the collected money can be used according to the needs.

Role of Rewards

Make sure to offer rewards for every category of investors. Set different limits and offer an enticing reward on each so that the investor is encouraged to invest, be it more or less. Provide the investors with full information and tell what they are dealing with. Transparency of the business plan will encourage them to invest openly. Besides, make use of ‘limited period offer’ to get the benefit of now or never.

Networking

It is essential to launch a campaign before raising funds. Participate and involve as many industrial clients as you can. Make use of social media platforms and reach to mass so that you engage with potential investors. Your supporters have every right to know about the progress made. So launch social media campaigns and do not hesitate to make the use of video marketing to make people aware of the development of the project.

According to reports, the advent of mobile technology in India has made it the second-largest internet market in the world facilitating easy online payments and thus encouraging crowdfunding. Here are some of the crowdfunding sites working in India:

1. Kickstarter

This is the first crowdfunding site in India focusing on creative projects. It works on getting funds for a wide range of projects from health technology to films. One of its successful projects is the Sweet Requiem campaign, a film on Indian Tibetan women. This project raised USD 33,889.

2. Wishberry

Based on creativity, this platform aims to generate funds for creative projects in India. It raises funds for Arts, theatre, music,etc. focusing on to bring innovative ideas to life.

3. Ketto

This platform works to generate funds for health, education, animal welfare and women empowerment in India. It encourages investors to donate by offering rewards.

Though the concept has just started in India, the SMEs have already started to enjoy its benefits.