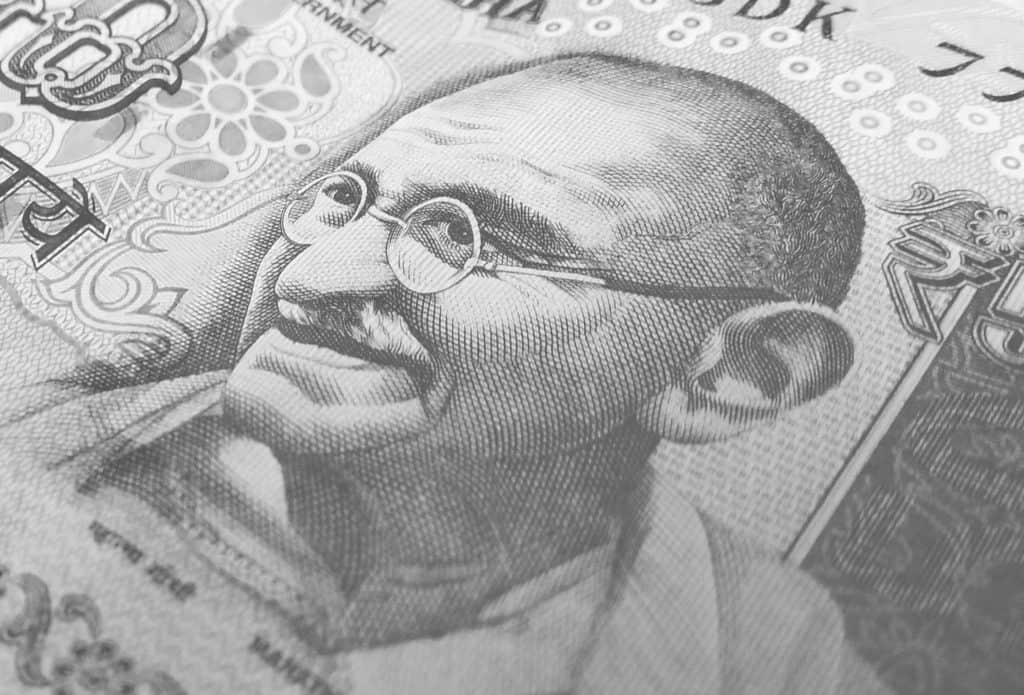

Rupee loses the momentum in Wednesday’s session erasing last session’s gains to settle low against US Dollar. After opening weak, Rupee loses further grounds to settle at 75.69 provisionally losing 21 paise against the previous close. At the interbank exchange market, Rupee rallied weakly between a low of 75.75 and a high of 75.58 posing a weak rally.

Forex traders lost hopes with the feeble domestic equity market, fears of 2nd wave of Coronavirus and another lockdown to curb rising cases weighed on investor sentiments. Analysts believe that India-China border tensions will further grapple economic senses.

USD/INR – Crude Price Fells from Target

Brent crude oil slips 1.1% to settle at USD 42.16 per barrel after rising the highest since March plunge on Tuesday. US WTI crude drops 1.5% to USD 39.78 per barrel losing the USD 40 mark. Crude oil prices slump in today’s session with rising worries over 2nd wave of Coronavirus amid restarting of economies.

Investors’ sentiments are unnerved after COVID-19 cases see an uprise in the US, China, India and other countries. Analysts fear that these centres being important for Oil production and consumption can experience another lockdown degrading the global economy. Further, API stated that oil prices are under pressure as a rise in expected US crude inventories. OPEC+ is supporting the crude prices with slashing output cuts and shutting up of oil wells.

USD/INR – Gold Prices Surge with Rising Concerns

Gold prices reach sky-high for eight years. However, the abrupt rise in Coronavirus cases dents the hopes of economic recovery. Spot gold surges 0.6% to USD 1777.53 an ounce having risen this highest in October 2012. US Gold futures climbed 0.7% to USD 1794.60 close to achieving the USD 1800 level. With fears growing in the economy, investors are shifting to safe-haven, making it surge.

Gold rally is expecting a constant decisive run with fears of 2nd wave of Coronavirus affecting the global economy. Investors are also expecting stimulus packages benefitting the gold. Central banks earlier provided the stimulus and kept the interest rates low for the pandemic to ease down, thus making gold rise more than 16% this year. SPDR Gold Trust holdings soar 0.28% to 1169.25 tonnes yesterday, making to the highest since April 2013.

Domestic gold prices crossed INR 50000 per 10 grams for the very first time on 24 June’s session following the weak global economy and dropping Rupee.