The bill of lading (BL) signifies the successful completion of trade on the receipt of consignment. Fundamentally, the transportation company issues this document with a clear depiction of the agreement between the shipper and the company regarding the deal. Since, the means of the transaction could be land, air, or sea specific bill lading bound to the same is issued. Further, it is almost impossible to complete the trade without a bill of lading.

Significance of Bill of Lading

As mentioned earlier, a transaction is devoid of the Bill of Lading is insignificant. Because it carries all the necessary information to carry out the consignment accurately. Thereby, the issuance of it depicts the correctness of all the documents from the exporter. Moreover, it is necessary due to the following reasons:

- It has details off all the goods.

- This bill acts as a shipment receipt and confirms the receipt of consignments.

- Further, it outlines the terms, conditions, and responsibilities of both the exporter and transportation company.

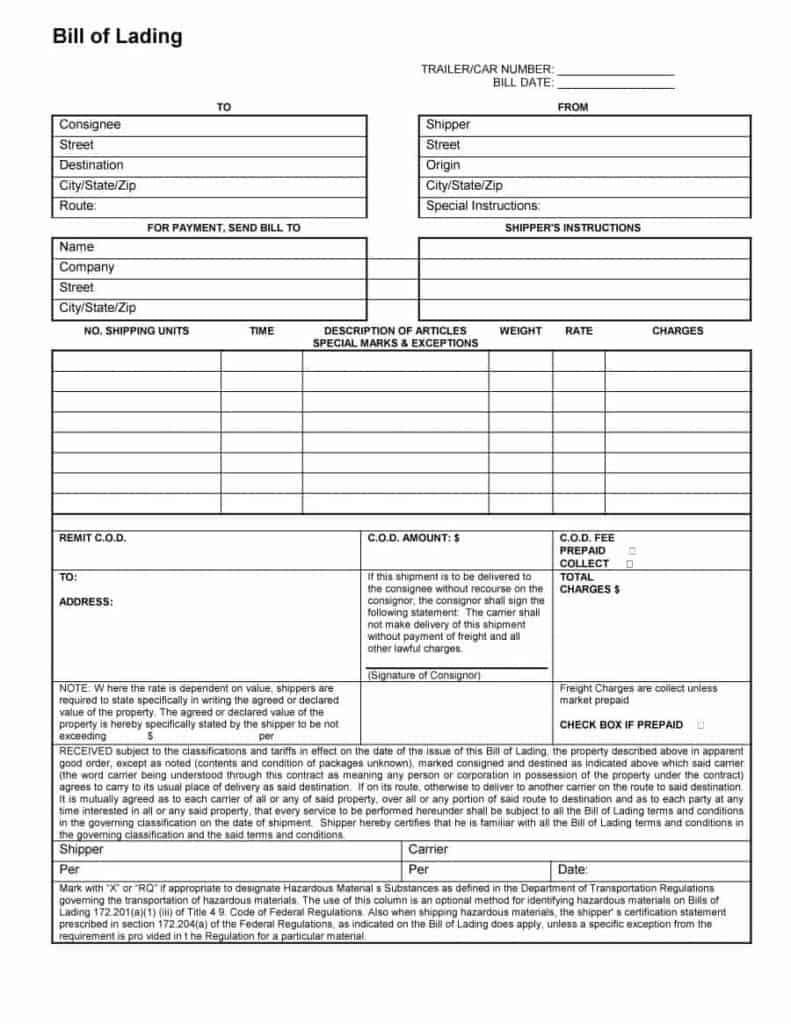

Find the BL Draft Below:

Contents of Bill of Lading

The Bill of Lading encompasses of the following details

- Exporter, Consignee and importers names and their respective addresses.

- PO (special account number) for tracking orders.

- Emphasize any instructions to certify swift delivery.

- Shipment date.

- Shipping unit number/Container Number.

- Packaging type (cartons, pallets, skids, drums, etc.).

- Highlight if the shipment contains any hazardous contents.

- Item description (through detailed description is expected).

- Freight classification.

- Weight of the goods (mention each commodity weight).

- Value of the commodities.

Type of Lading

Negotiable Bill of Lading

In this bill, the goods are delivered to anyone who posses the original bill copy. However, in case of its absence, no one will receive the freight.

Non-Negotiable Bill of Lading

This type sets a receiver who will receive the consignment. Here, the receiver can issue the freight on proving his identity.

Apart from the two sets of Bill of Lading, few other types based on execution are:

Straight Bill of Lading

This type allows a person who will receive the goods and this is a non- negotiable type of Bill of Lading. Further, this suggests that the endorsee will have no more rights than the endorser. Also, this is mainly incorporated in military shipments. However, banks consider this type of Bill of Lading no safe and secure.

Open Bill of Lading

This bill allows us to change the consignee with just a signature, that is it is transferable. Moreover, the transfer could be multiple times. Also, the switch bill of lading is a type under the open bill of lading.

Bearer Bill of Lading

This is similar to the negotiable form of the bill where the individual possessing the original copy of the bill will issue the consignment. Subsequently, this is usually the case when the allotment of the receiver is ambiguous. Nonetheless, this is used to ship bulk orders in small bits.

To Order Bill of Lading

This bill specifies the name of the consignee who will receive the consignment (delivery to an Ltd. Assignee or so on). Accordingly, due to its specificity, this is the most common and modern type of bill across the world. Further, certifies safe delivery to the assignee receiver. Further, to avoid fraudulent receipt of the cargo this is an apt bill confirming the accurate transaction. ‘To order’ BL is mostly issued for Letter of Credit payment terms based transactions. Besides, it has two categories

- To order, Blank Endorsed: specify the consignee’s name along with consignors signature and stamp. Also, with signature the title is transferable

- To order, Bank: this facilitates the consignee to receive the cargo with the bank’s approval.

Additional types of Bill of lading based on the operation method

- Receipt of Shipment BL: This confirms the delivery of goods, sent from agent to shipper

- Shipped on Board BL: Issue this after loading the consignment on board. Further, this legally binds the shipowner and shipper.

- Clean BL: After, loading of board this bill verifies that all goods are in good condition

- Soiled BL: This suggests that the goods were in bad condition upon arrival

- Through BL: This is a legal document that facilitates the transaction from starting A to destination B

- Combined transporter BL: This is usually for long consignment giving details on the goods

- Dirty BL: It is similar to the Soiled BL, this shows the consignment isn’t in good condition.

Issue an airway bill if the means of transaction is airways, inland bill for the transaction via road or rail, ocean bill for the transaction via sea.

Note

It is advised to have three sets of Bill of Lading; in case the original is lost. Moreover, it is clearly present in the guidelines of BL. Furthermore, the Bill of Lading abides by conventions that state the contract of carriage such as Hamburg Rules, Rotterdam Rules, Hague Rules, US COGSA, and Hague- Visby Rules.

Prior Signing the Bill of landing

It is important to carefully check certain thing before signing the bill. Consequently, the details must be clear leaving no room for ambiguity. For instance, the identity of the shipper, port of loading with date, discharge port, consignment condition, the quantity of the shipment with description, freight, and terms of conflict.

Electronic Bill of Lading

With the modernization of the export sector, the paper bill poses many problems such as slow movement and ease to forge. Thereby, using the electronic bill of lading might be quite suitable for the advancement.

Advantages and disadvantages of electronic BL

- The transaction is paperless.

- Instant transfer of BL to any part of the world facilitating quick trade.

- Any changes can be easily made in contrast to the paper BL.

- A proper electronic BL will diminish frauds.

- The negotiable transfer is difficult.

- Chances of hacking are high leading to manipulation of the transactions.