The bank provides a 14 digit code to dealers owning a current account that is the Authorised Dealer Code. Specifically, necessary for registering it at the consignment’s port respectively during custom goods clearance. Consequently, the dealer’s Customs House Agent (CHA) will ask for this code at the respective ports for port registration of importer or exporter. Further, it facilitates the easy retrieval of foreign currency during the trade.

AD Code’s Necessity in Exports

- It is mandatory for customs clearance (its absence will trample the generation of shipping bill that is obligatory for customs clearance)

- The Electronic Data Interchange (EDI) system, a part of ICEGATE Portal will impede shipping bill generation without it

- Registration of AD code with Customs permits the direct transfer of credit to traders current account

Applying for AD code

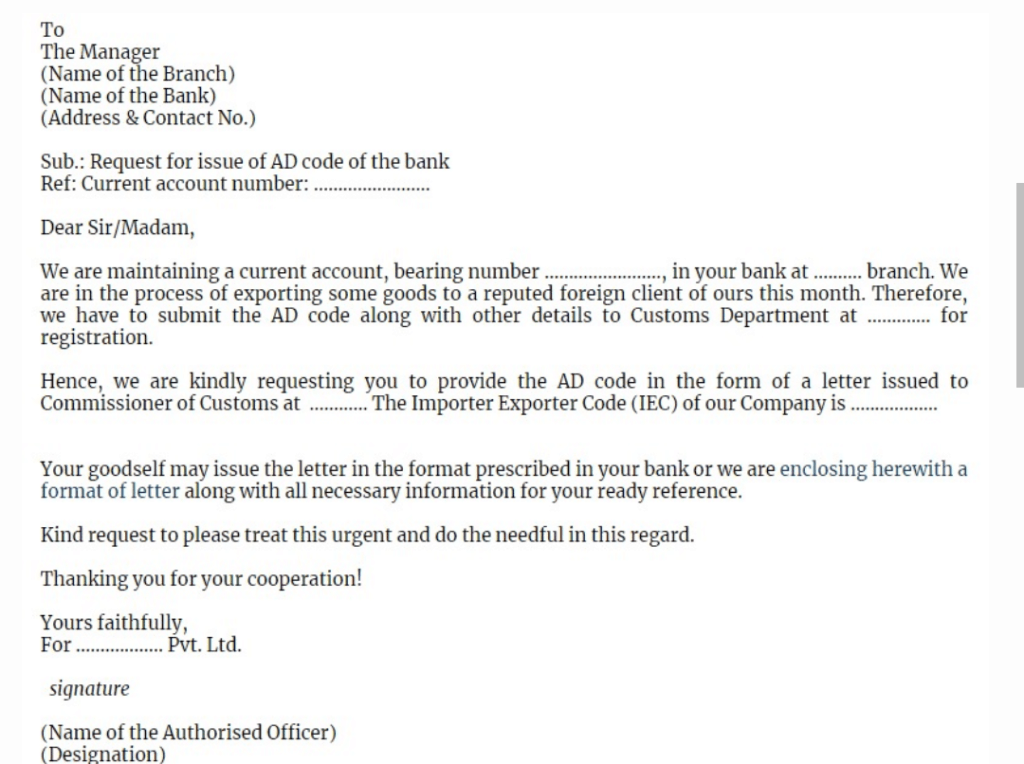

As mentioned earlier, the bank issues the code by confirming the applicant’s current account in the same. Accordingly, this is simple to attain that is by providing a letter requesting the same. Note that, the letter must follow a prescribed manner. Following that, the bank will issue the code in its letterhead.

Documents that must be submitted at the bank

- The letter requesting for AD code

- IEC (Import Export Code) copy

- PAN card copy

- Export House Certificate (non-compulsory)

Registration of AD code

It is essential to enroll the code at the port. Further, it is obligatory to register this at every port of export shipment. Following the issue of the AD code, the registration process begins with the CHA. That is the submission of documents to the CHA. In return, CHA on your behalf will submit the same to customs. For this purpose, it will take about 3-4 business days. Moreover, once registered at a port, the same is valid for a lifetime.

Documents to be Submitted

The documents vary depending on the status of the dealer. Expect the letterhead from the bank, the rest of the documents should be self-attested.

- AD Code letter on banker’s letterhead

- GST Registration

- IT returns of the company (3 years)

- Bank statement (1 year)

- IE code

- PAN (Company’s PAN)

- Board resolution

- Director or Partner or Proprietor basic info (PAN, Aadhaar card, Voter ID, Passport Copy)

- Export house Certificate

Subsequently, after the submission of the documents, the shipment is ready for clearance. Besides, the dealer gets aware of AD code acceptance when EDI generates a shipping bill during export filing.

Alignments

If changes are to be made, follow the steps given below

- Submission of documents- a letter describing the necessary changes with reasons. Along with a request to cancel the existing Ad code

- Provide the Email ID of the bank- this is solely for verification purpose

- Further, the EDI helpdesk will guide for changes

- Finally, a new AD will be provided

Considering its importance, an export must obtain AD code and consequently register it with customs. By doing so, the dealer can expect a smooth transaction with no hindrance. All export benefits such as GST Refund, Drawback Duty, Transport and Marketing Scheme, etc will be credited to the account number under which AD code is registered at the port.