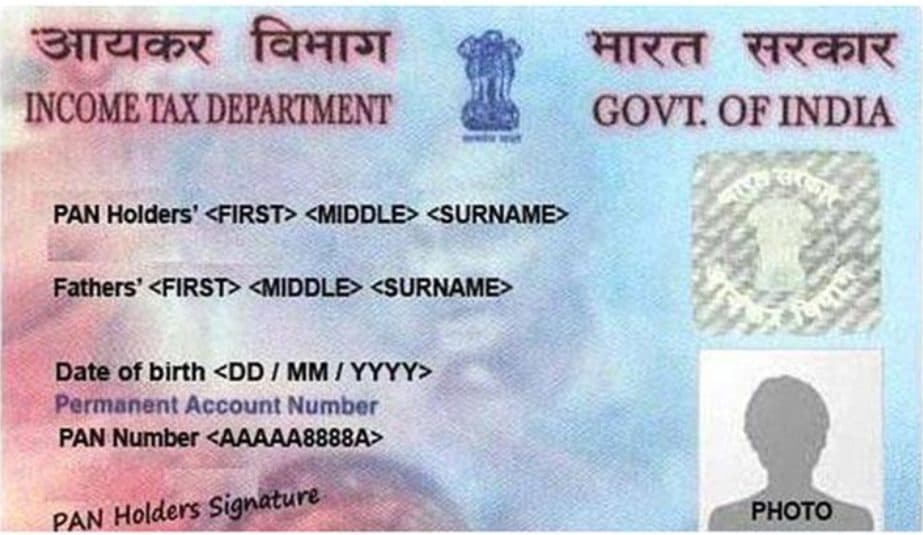

A unique ten characters assigned to a taxpayer is the Permanent Account Number (PAN card). This card serves as identity proof in various scenarios. Subsequently, it is mandatory to carry out any form of financial transaction at the bank. Similarly, PAN card is obligatory to fill an individual’s Income tax returns alongside all memos with the Income-tax authority.

A brief evolution of PAN Card

The concept of PAN card came into existence in 1976. Yet, within four years it became compulsory for all taxpayers. Since 1995, the mandatory status is severely emphasized. Consequently, in 1996 Delhi, Mumbai, and Chennai adapted the status. Following that, the rest of the country is ensuing the PAN card for every taxpayer policy. Besides taxpaying individuals, it is now necessary for all registered businesses (export business too) to issue a PAN card. As of now, a portal exclusively for corporates applying for PAN here from the Ministry of Corporate Affairs.

Requisition of PAN card for Company and firms

Highlight that, any form of business in India or elsewhere must possess a PAN card. In other words, any establishment that is generating an income must issue a PAN. Further, it is also necessary to quote the PAN in all the transactions (Invoices and registrations).

Applying for a PAN card: Business, company and firm purposes

The pan allotment is either by National Securities Depository Limited (NSDL)/ e-Governance Infrastructure Ltd or UTI Infrastructure Technology Services Ltd (UTIITSL). Further, an individual can apply for Pan via online medium using their homepages or offline by procuring an application form from the local agent. Note that, the three important steps for applying are to fill the form, attach necessary documents, and finally submit it with a minimal fee.

Protocol to apply for PAN

Application form

As mentioned earlier, this task can be performed offline or online

- Online- Acquire and fill the application form in the following manner:

- Visit either NSDL or UTIITSL website to obtain the form. Next, choose from the Indian citizens, NRIs or foreign citizen option.

- Select the application type along with Applicant Category

- Succeeding that, select Area code, assessing officer type, Range Code, assessing Officer number (this Assessing code field is dependent on the income tax jurisdiction of the applicant)

- Ensuing which basic information area will appear. Here, fill Name, Gender, Parent’s Name, email ID, Contact Number, Permanent address, Company address, Date of Incorporation, and Registration Number of the firm

- Next, mention the documents that you will submit as identity proof. Note that, the details in the documents and proof must coincide

- Following that, remark the source of income

In-case, another individual is filling on behalf of the applicant, fill Form 49A.

2. Offline- Acquire the form from a local agent or from Income Tax Offices in India. Fill the application similarly as the online mode.

Alternative feasible methods include e-KYC and digital signature that allows the use of Aadhaar details without having to put in photo, signature, and supporting documents manually. However, with one step extension in this method i.e. Aadhaar authentication process. Nonetheless, other protocols also mandate the Aadhaar authentication process.

Payment of fees

The options to pay the fee are by credit card, debit card, demand draft (DD), or net-banking. In case, the mode of payment is DD, submit a copy of the counterfoil along with other documents. Accordingly, the charge for the PAN card is Rs 107 (Hard copy), while the e-PAN charge is Rs 72. After completion of the payment, obtain a 15- digit number as acknowledgment. Keep it safe for future references.

Submission of the Application Form

Following the filling and payment, it is easy to submit the form online as it is just by clicking in submit. However, offline is via the UTTITSL PAN agency or manual submission. Additionally, attach a photograph and sign in the appropriate place in both modes. Send in the form and the documents to the following address

Income Tax PAN Services Unit

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling,

Plot No.341, Survey No.997,8,

Model Colony, Near Deep Bungalow Chowk.

Pune- 411016.

Documents Required

Several documents must be submitted accompanying the application form. Further, it is necessary to submit the documents within 15 days of submission of the application form. Now, the list of documents depends on the type of business, company or firm. Henceforth, a list of documents under the type are itemized.

- For a Proprietorship Firm– As this is not a legal firm, basic documents of the individual or the proprietor are necessary. Such as Identity Proof, Address Proof, and Proof of Date of Birth.

- For a company– The significant document is the copy of Incorporation Certificate from Registrar of Companies (ROC)

- In case of a Partnership firm– Two necessary documents are Copy of Partnership Deed and the Registration Certificate from Registration of Firms

- For a Limited Liability Partnership (LLP)– The same documents required by the Partnership firm that is, a Copy of Partnership Deed and the Registration Certificate from ROC.

- For a foreign company– As ID proof submit one of either document. One is Copy of Registration Certificate from country of Applicant notarised by the Indian embassy or High Commission or Consulate of the Applicant residing country. Another option is to issue a Registration copy in India with approval for setting up an establishment in India.

Processing and issuing of PAN

Following the submission of documents, the department will securitize the same to avoid defaulters. Succeeding that, PAN will be delivered to the mentioned address within 15 days.

Points to remember

- Fill the application in capital letters to avoid ambiguity. Also, avoid unwanted overwriting and corrections.

- Always fill the form in English and note that surname comes before the first name in the form.

- Never apply for a new PAN if the previous one is lost as this imposes a fine of Rs 10,000 for owning two PAN cards.

- Always provide correct communication details by its contact number, email, or address and the right Aadhaar details.

- In the case of LLP, prior registration with government authority is a must.

- Remember that, the fourth letter stands for the type of PAN Holder.

- After issuing PAN, it is necessary to open a current account to start the transaction of the business, company, or a firm.