Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) aims at improving the availability of regular and adequate credit for Micro and Small Enterprises (MSEs). Inadequate credit resources is the sole reason that hampers the development of small enterprises in India. In addition, the Indian government is striving to provide adequate credit resources through these schemes.

Ministry of Micro, Small and Medium Enterprises, Government of India (GOI), and Small Industries Development Bank of India (SIDBI) setup CGTMSE scheme to provide collateral-free credit to the MSMEs.

Security

CGTMSE provides a hybrid security cover to the lender for the credit amount not covered by collateral security of MSME. The maximum amount for hybrid security cover stands at Rupees 200 lakh (2 crores). Similarly, it applies for partial security cover where hybrid security covers a maximum 200 lakh over on borrowers collateral. The main objective of this scheme is ease for MSMEs to avail credit facility without worrying about the collateral security. In case the MSME defaults on the loan, the credit guarantee trust would cover the loss incurred by the lender from minimum 50% to maximum 85% of the total credit defaulted.

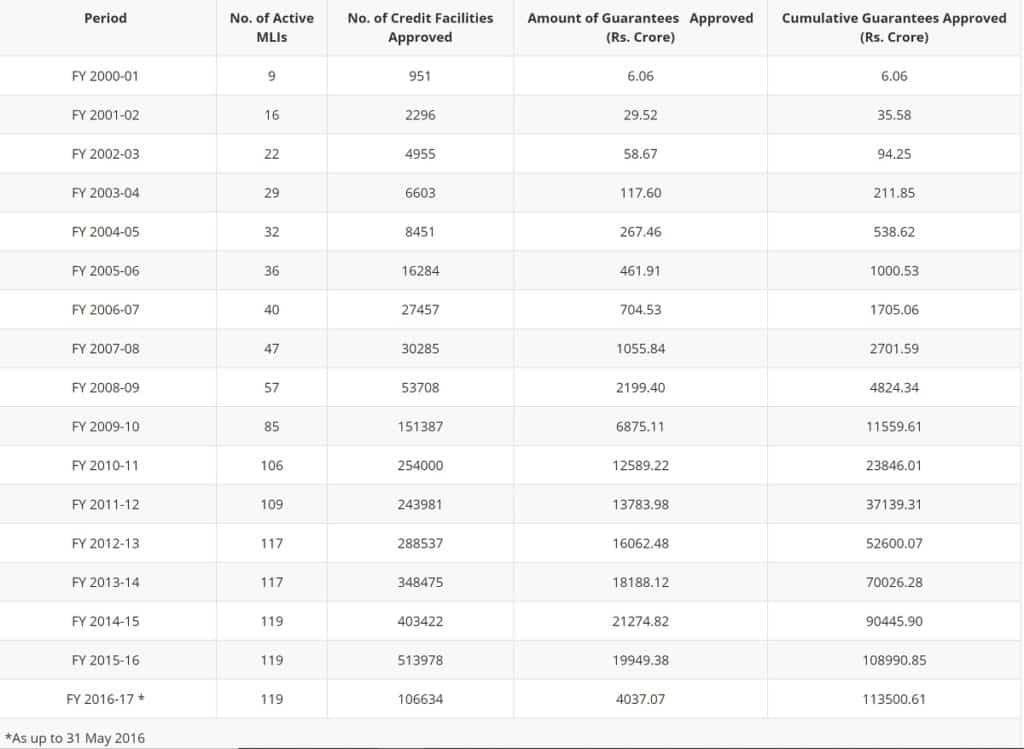

Initially, CGTMSE was put into force on August 30, 2000, for both existing and new businesses. Government of India and SIDBI hurl the trust fund in a 1:4 ratio with up to Rs 2477.78 crore in the trust. Further, they planned to cross Rs 2500 crore within the completion 11th plan. One of the prominent features of the scheme is providing assistance without the third-party security involvement.

Objectives CGTMSE

- To provide financial assurance to financial institutions that lend to SMEs and MSMEs.

- To encourage new start-ups to concur security-free advances .

- The fund aims to provide term loans and composite credit. In addition, it checks the practicalities of the projects undertaken by these enterprises before providing assistance.

Eligible Lenders

- Commercial banks, chosen Regional Rural Banks, certain State Financial Corporations, NBFCs, SFBs are eligible to lend financial assistance. Further, institutions directed by GOI can benefit the guarantee cover under this scheme. Additionally, SIDBI, NSIC, NEDFI have been added to the list of institutions. For List of Institutions click here

Eligible Debtors

- Mentioned above, all existing and new enterprises that belong to the MSME sectors are eligible borrowers. However, educational institutions, agriculture, self-help groups, training institutions, etc., are not considered suitable to claim their entitlement under the scheme.

Salient Features of the Scheme

The trust fund generated by the CGTMSE provides several benefits and works on the features mentioned herewith

- Funds and assistance is provided up to Rs 200 lakh with security free and third party assurance is not mandatory.

- For majority enterprises trust covers 75% to 85% credit amount as hybrid security in case of default

- For Retail Trade Enterprises 50% guarantee is provided loan amount exceeding Rs 50 lacs up to 100 lacs.

- On the contrary, if the amount is less than Rs 5 lakhs, 85% guarantee is assured.

- The loans provided to MSMEs driven by women and in the Northeast Regions are given a special category. Maximum guarantee under CGTMSE under this category equals to 80%.

| Type of Unit | CGTMSE Covered by Trust | Credit Limit CGTMSE |

| Micro Enterprises | 85% | Maximum 5 Lacs |

| Micro Enterprises | 75% | 5 Lacs to 50 Lacs |

| Micro and Small Enterprises Retail Trade Activity | 50% | 10 Lacs to 100 Lacs |

| Micro and Small Enterprises Operated/Owned by Women | 80% | Maximum 50 Lacs |

| Micro and Small Enterprises Operated/Owned by Women | 75% | 50 Lacs to 200 Lacs |

| MSE Loans in the North East Region | 80% | Maximum 50 Lacs |

| MSE Loans in the North East Region | 75% | 50 Lacs to 200 Lacs |

| Other SMEs and MSMEs | 75% | 5 Lacs to 200 Lacs |

Protocol to Apply

To avail the benefits of this scheme it is important to follow the guidelines mentioned below:

- Initially, a plan must be prepared that must include the business idea, financial details, outline of the project, etc. It is important to mention the viability of the project.

- Next, the decision of which bank to approach for a loan must be made. Once the decision is made, the application along with the business plan must be presented to the bank.

- Further, the bank will verify the details provided in the application and the model submitted to reject defaulters.

- CGTMSE does scrutiny once the application is passed from banks.

- Consequently, after the approval, the fund will instruct the bank to issue the amounts.

- The borrowers must pay a CGTMSE guarantee and service fee.

Service Fees

A percentage of 1% per annum of the total loaned amount must be paid as the service fee

- 0.75% for a loan of Rs 5 lakh and less.

- 0.85% for a loan over Rs 5 lakh till Rs 100 lakh.

The tenure of guarantee is for 5 years.